Capology Recap

ProHockeyRumors occasionally delves into the inner workings of the CBA to explain concepts crucial to modern NHL deals. Check out our past Capology posts and be on the lookout for future ones.

Capology 101 Posts

Buyouts: Explaining how NHL buyouts work and how to calculate a buyout’s cap hit.

Player Contracts: Outlining the limitations imposed by the CBA on player contracts.

NTCs and NMCs: Defining and explaining no-trade clauses and no-movement clauses.

RFA (Part One): Exploring what it means to be a restricted free agent.

Salary Arbitration (Part One and Two): Examining salary arbitration eligibility and the hearing process.

Capology 101: Arbitration (Part 2)

In part one of our arbitration series we looked at arbitration eligibility. This next section details the hearing process, including permissible evidence and the repercussions of the arbitrator’s decision.

Salary arbitration determines a player’s salary through a hearing governed by a third-party arbitrator. The arbitrator takes all the permissible evidence into account in deciding how much a player should be paid per year. This section outlines three key elements of that process: term, permissible evidence, and the decision.

Term

The party being brought to salary arbitration chooses whether the decision is for one or two years. If a team chooses, however, they are restricted to one year if the player is eligible for unrestricted free agent the following year.

Evidence

Parties can present witnesses, affidavits (sworn written testimony), documents, statistics, and any other relevant evidence during the hearing, subject to certain restrictions (see more below). The CBA suggests the following preferred evidence:

- the player’s overall performance in previous seasons;

- number of games played in context of injuries or illnesses (or lack thereof);

- length of service in the league or with the team;

- how much a player contributed to the success/failure of his team last season;

- special qualities of leadership or public appeal relevant to his team responsibilities (i.e. the intangibles).

- performance of players considered comparable to the player in question by either party; or

- compensation of players considered comparable to the player in question by either party.

As stated above, this list is subject to certain restrictions. The CBA prohibits parties from introducing or using the following:

- any contract signed outside restricted free agency, including one signed after a team exercises a walk-away right;

- any contract of a player not considered a comparable by either party;

- any contract otherwise permissible that is signed less than three hours before the hearing starts.

- qualifying offers;

- the negotiation history between the parties, including any offers made;

- testimonials, videotapes, newspaper columns, press game reports, or similar materials;

- references to walk-away rights;

- any award issued by an arbitrator that preceded a team exercising its walk-away rights;

- a team or NHL’s financial condition;

- a team’s salary cap (or floor) situation;

- any salary arbitration award issued in ’05-’06; or

- compensation information for salary arbitration awards issued before July 22nd 2005.

There are three main takeaways from the evidentiary rules. One, the arbitrator’s decision is based largely on a player’s stats and intangibles, and the compensation received by players with similar stats and intangibles. Two, visual evidence such as highlight reels and game tape do not factor in to the arbitrator’s decision. This makes any determination strictly fact-based. Finally, if, during a players hearing, a comparable player signs an otherwise admissible contract, that contract cannot be used as evidence by either party.

Decision

The arbitrator’s decision comes within 48 hours after the hearing closes. The decision states:

- the contract term (one or two years as mentioned above);

- NHL salary to be paid by the team for that term;

- whether it is a two-way contract, and how much the player is paid in the AHL; and

- a statement explaining the decision.

Walk Away Rights

A team may reject an arbitration decision in a player-elected salary arbitration if the award is $3.9MM or more per year. That threshold increases by the same percentage rate that the average league salary increases.

A team does not have unlimited walk away rights. Rather, the number of times a team can reject a decision is tied to the number of decisions issued. A team facing up to two decisions has one walk away right. A team facing three of four decisions has two walk away rights. Finally, a team facing five decisions has three walk away rights.

The consequences of rejecting a decision depends on whether the club elected a one or two year term. If the decision is for a one year term, the player immediately becomes an unrestricted free agent. If the decision is for a two year term, the player and team enter into a one year contract for the salary awarded. The player becomes an unrestricted free agent at the end of that year.

Ryane Clowe To Join Devils Coaching Staff

According to a release from the New Jersey Devils, Ryane Clowe has been named an assistant under head coach John Hynes. Clowe, a rugged power forward in his playing days, hasn’t suited up for the Devils since November 6th, 2014 due to complications stemming from the several concussions he sustained during his playing career.

Clowe spent the first seven-plus seasons of his NHL career as a member of the San Jose Sharks and tallied 101 goals along with 170 assists. He also found time to rack up 567 PIMs while with the Sharks.

The New York Rangers acquired Clowe ahead of the 2013 trade deadline in exchange for multiple draft picks. He would see action in 12 regular season contests and another two in the playoffs before leaving the team in the summer as a free agent to sign with the Devils.

Because Clowe has not officially retired, his $4.85MM cap hit will remain on the books for salary cap purposes, helping the club reach the salary floor. The team can clear that cap hit by placing the player on LTIR prior to the season starting. It seems strange a player’s cap hit can remain on the books while he’s working in a non-playing capacity for the organization but the current NHL CBA allows it. In fact, while still a member of the Flyers prior to his cap hit being dealt to Arizona, Chris Pronger held a position in Philadelphia’s front office.

Snapshots: Stamkos And Subban

The Steven Stamkos bidding war was ended very quickly by the player re-signing with the Tampa Bay Lightning. Stamkos was pitched by just three teams (Montreal, Buffalo, Toronto) before ending the process. That may be because of the Maple Leafs’ pitch, according to Steve Simmons of the Toronto Sun.

While teams bringing in big names to woo players isn’t uncommon (Oilers legends Paul Coffey and Wayne Gretzky were famously involved in the Oilers acquiring Justin Schultz), the Maple Leafs may have gone overboard. Back in June, Simmons reported team president Brendan Shanahan, GM Lou Lamoriello, Toronto mayor John Tory, and Canadian Tire CEO Michael B. Medine all met with Stamkos to sell the Maple Leafs, Toronto, and potential endorsement opportunities. Simmons reported Sunday that after the meeting, Stamkos told his agent that he didn’t want any more meetings and he wanted to speak with Lightning GM Steve Yzerman. He was officially re-signed two days after his meeting in Toronto.

Other notes from around the league:

- It was reported shortly after the P.K. Subban/ Shea Weber trade on June 29 that Nashville Predators would not honor Subban’s no-trade clause (NTC). Vice Sports columnist Sean McIndoe explored the bizarre rule that allowed the Predators to nix the clause one day before it was supposed to come into effect. Essentially, the CBA rules state that those clauses are binding to the acquiring team, unless the clause hasn’t come into effect yet. An NTC is often a hard-fought-for part of a contract, with players sometimes taking concessions on salary or term in order to get it. However, its doubtful that Subban made any concessions to get one, considering he will make $9MM per year until 2022. And while its also unlikely that the Predators will trade their new superstar, Subban would have no say if they decided to move him out before the end of his contract. Our Mike Furlano has previously explained no-trade and no-move clauses in more depth.

- Canadiens GM Marc Bergevin told NHL.com that he has stayed away from reading media reports about the Subban trade, saying fans and media are guessing at what goes on behind the scenes. The Canadiens GM says he wants to “unplug” after a tough season. Bergevin also spoke about comparisons between the Patrick Roy trade and the Subban one, saying Roy won “two Stanley Cups … I’ve always believed that winning a Stanley Cup changes everything”.

The Death of the Bridge Deal

As further evidenced by today’s signings of Nathan MacKinnon and Mark Scheifele, short and relatively inexpensive contracts for young restricted free agents in the NHL are going the way of the dinosaurs. MacKinnon, the first overall pick by the Avalanche in the 2013 NHL draft and still just 20 years old, agreed to terms on a seven-year, $44.1MM contract. Scheifele, a tad older at 23, signed on for eight more years with the Winnipeg Jets for $49MM. Around the league, contracts such as these have become the norm for players who are not yet even old enough to rent a car. It’s a trend that is considered troublesome to some and encouraging to others. For NHL owners, it is burning a hole in their wallets, and sooner or later, a stance will be made.

Last summer, after playing less than 200 games in the NHL, the Blues signed 23-year-old Vladimir Tarasenko to an eight-year, $60MM dollar contract, keeping him in St. Louis into his 30’s. Elsewhere, the Boston Bruins and Chicago Blackhawks were forced to trade young stars Dougie Hamilton and Brandon Saad, respectively, due to their contract demands. The Calgary Flames were happy to give the 22-year-old Hamilton $35.5MM over six years, and the Columbus Blue Jacket went just one step further, inking the 22-year-old Saad to a six-year, $36MM contract. The Bruins had already succumbed to the pressures of signing a star RFA, giving 20-year-old Tyler Seguin a six-year $34.5MM deal in 2012, and then panicking at the perceived sunk cost and trading him to the Dallas Stars a year later. In 2012, the Edmonton Oilers rewarded 21-year-old Taylor Hall with a seven-year, $42MM deal, and then gave fellow first overall pick Ryan Nugent-Hopkins an identical contract the following summer, again at just 21 years old. The Colorado Avalanche were no strangers to this scenario when completing the new MacKinnon deal; they signed Matt Duchene for five years, $30MM at 23 in 2013 and traded Ryan O’Reilly to the Buffalo Sabres last summer, where he signed for seven years and $52.5MM at 24 years old.

If the past few years weren’t enough to convince the hockey world that young talent is no longer synonymous with cheap talent, the past calendar year has put the debate to rest. Now including Scheifele and MacKinnon, over ten players aged 25 and under have signed contracts for five or more years and $20MM plus. This includes four players on the Florida Panthers alone, who have locked up Aaron Ekblad, Aleksander Barkov, Vincent Trocheck, and Reilly Smith long-term, but at $23.15MM dollars per year, starting in 2017. That is nearly a third of this year’s salary cap limit, spent on only four players, and only Smith has played over 200 games (285). More astronomical deals are certainly on their way, with players like the Flames’ duo of Johnny Gaudreau and Sean Monahan, Nikita Kucherov, Chris Kreider, Mike Hoffman, Jacob Trouba, Mat Dumba, and more still remaining unsigned as restricted free agents. The most likely trade victim this year is none other than Tyson Barrie, yet another member of the Avalanche, who is likely asking for more than Colorado can give him, as their tight cap room was squeezed even tighter by the MacKinnon deal.

Some argue that this is just a natural progression in the game of hockey. As the game grows and the NHL makes more money, players expect to be paid more. As the game grows smaller and faster, younger players are able to excel and make a greater difference quicker than they used to. The next logical step is that young players begin to demand more money. The trend began with young superstars like Sidney Crosby and Alexander Ovechkin, but has now grown to include all contributing young players. Gone are the days when production from players under 25 can come cheap as a reward for good drafting and development. Owners and general managers have begun to realize that the entry-level contract is now the only surefire affordable contract, as the “bridge” to a players first big-time contract at 27 or 28 is all but burnt. The “prime” age in hockey is getting lower and lower, and the young players want to be paid like a prime-time contributor. At this rate, a player like Connor McDavid might make $10MM a season by the time he’s ready to sign his second contract, a value that was completely inconceivable not long ago.

The owners have two choices about how to handle this issue. The first would be to simply accept it, a decision that would be greatly helped by the continued growth of NHL revenue and the subsequent growth of the salary cap. The second choice is much more dire: the owners could make limiting the second contract of young players the rock on which they stand in the next NHL Collective Bargaining Agreement negotiation. If contracts continue to swell for young players, and the growth is not consistent with revenue, the NHL could reach a point where an increasing salary cap is hurting owners’ bottom lines, or possibly even worse, the cap does not increase and young players salaries are forcing veteran players out of the league prematurely. Just looking around the league right now, there is an argument to be made that capable older players, like the many unrestricted free agents still remaining, would not still be unsigned at this point in the summer only five or ten years ago.

It is always good for young athletes to be paid their market value and to not be taken advantage of, and there is no argument that the majority of these players deserve the contracts that they are getting. However, if unregulated contract growth, especially among players under 25, continues at a rate that is greater than NHL revenue growth or salary cap increases, there will be consequences. Owners cannot be expected to dump more money into less established assets at their own expense and at the expense of veteran players. That is the reality of the NHL currently, but things seem likely to change, one way or another. The bridge deal is dead… for now.

Capology 101: Arbitration (Part 1)

Salary arbitration remains one of the more complex aspects of the NHL’s CBA. With the player-elected salary arbitration notice deadline passing this afternoon, ProHockeyRumors is here to give you a breakdown of the process.

At its heart, salary arbitration is simply asking a designated third-party arbitrator to determine a player’s salary. Both sides—the team and the player—present their case to the arbitrator. Like in court, the parties will use evidence such as graphs, statistics, and comparable players to make their case. Arbitration presents an independent and decisive way to determine a player’s salary in situations where both parties are at odds. The process, however, is inherently unpredictable, and is why most players and teams facing arbitration hearings settle before being heard.

Arbitration Basics

Two types of salary arbitration exist: (1) player-elected salary arbitration (PESA), and (2) club-elected salary arbitration (CESA). Definition-wise, they differ only in who elects the arbitration hearing. The difference lies in the procedure requirements.

Player Eligibility

A player’s arbitration eligibility is the same regardless of whether arbitration is player-elected or club-elected. A player is arbitration eligible if:

- He qualifies as a restricted free agent;

- He did not sign an offer sheet; and

- He meets the minimum professional experience guidelines.

The first two criteria are self-explanatory. The third, however, requires some additional explanation. The minimum professional experience (PE) required for salary arbitration eligibility depends on when a player signed his first Standard Player Contract (SPC):

- If a player signs his first SPC at 18-20, he needs four years of PE;

- If a player signs his first SPC at 21, he needs three years of PE;

- If a player signs his first SPC at 22-23, he needs two years of PE;

- If a player signs his first SPC at 24 or older, he needs one year of PE.

As with everything in the CBA, each key word entails specific definitions. Here, both age and professional experience are specifically defined.

Age is defined as the player’s age on September 15th of the calendar year he signed the SPC. That means that if a player born in July signs an SPC in June at 20 years old, his age for eligibility purposes is 21 because he is 21 on September 15th.

Professional experience is defined as a condition of age. An 18 or 19 year old player must play in 10 or more NHL games to accumulate a year of professional experience. Players 20+, however, accumulate a year of professional experience by playing in any professional league (AHL, KHL, etc).

Additional CESA eligibility requirements

In addition to a player being arbitration-eligible, the CBA requires more for club-elected salary arbitration. A club can only elect salary arbitration for a player who has not been subject to a previous club-elected salary (any team), and either:

- made more than $1.75MM (including bonuses) in the previous year and in lieu of a qualifying offer; or

- received but did not sign a qualifying offer.

Finally, a team may only elect salary arbitration twice per year.

Deadlines

The deadline for PESA is 5pm EST on July 5th. The deadline for CESA is either (a) the later of June 15th or 48 hours after the Stanley Cup Finals for arbitration in lieu of qualifying offers, or (b) 24 hours after the player-elected deadline passes.

Miscellaneous

Teams can trade players with pending arbitrations up until the hearing. Teams and players can also come to a contractual agreement. Because of the unpredictability mentioned above, players and teams rarely go to hearing—most cases settle.

Part Two will address the arbitration Process, and Part Three will address the arbitration decision.

The Signing Bonus: Rise Of The Buyout-Proof Contract

The life of an NHL agent is tough. As the league continues to tweak (or totally overhaul) their CBA each few seasons, changing contract regulations and offering teams different ways of structuring deals, agents are always trying to find ways to circumvent them and get the best offers for their clients.

With teams becoming more and more willing to use buyouts to rid themselves of the horrible contracts that they sign on July 1st – famously a day of simultaneous excitement and regret – agents around the league needed to find a way to protect their clients from losing out on a third (or sometimes two-thirds) of the salary the sides agreed on.

The most recent buyout window, which lasted from June 15th to 30th, saw a dozen NHL players bought out, including household names like Thomas Vanek and Dennis Seidenberg. While some fans may see this as an opportunity for a player to earn two contracts at the same time – Vanek was signed on by Detroit for $2.6MM on July 1st, more than the $1.5MM he surrendered in his buyout – most take it as a personal slight, an indictment of their play or character. Regardless, agents continue to try and secure guarantees for their clients, instead of leaving the power in the hands of the league’s general managers.

Enter the signing bonus, this summer’s contract-du-jour. All across the league, big name free agents have inked deals that will see them paid almost entirely in signing bonuses, with very little actual salary being given out each season. Take Loui Eriksson for instance:

2016-17 – Salary: $1MM, Bonus: $7MM

2017-18 – Salary: $1MM, Bonus: $7MM

2018-19 – Salary: $1MM, Bonus: $6MM

2019-20 – Salary: $1MM, Bonus: $4MM

2020-21 – Salary: $1MM, Bonus: $3MM

2021-22 – Salary: $3MM, Bonus: $1MM

While Eriksson’s cap-hit sits at $6MM per year, he’ll make more than that in bonuses alone each of the next three seasons. There are a couple of reasons why this would benefit the player.

For one, everyone loves getting a big check rather than a weekly salary – who would turn down a piece of paper with six zeros? As any economist will tell you, money in hand is worth more than money promised to come, and just as teams in other sports are deferring payments for this reason long into the future, having money up front is actually more valuable for the player in question.

It’s in the buyout rules that the contract really holds value though, as – hinted at by the title – these contracts are basically buyout-proof. Under the current CBA, buyouts are calculated by taking two-thirds of the remaining salary owed, not including signing bonuses, and spreading it out over twice the remaining contract length. The new cap hit is determined by subtracting the savings from the average annual value of the deal which includes signing bonuses.

This means that if the Canucks were to want to buy out Eriksson after say, the third year of his new deal, they’ll only be saving $333K of cap hit in 2020-21, an insignificant portion of the $6MM number. That last season of $3MM is a bit better for the Canucks (they would save $2MM of his cap hit), but structuring it this way almost guarantees that Eriksson will collect at least $35MM of his deal – more than 97%. It’s just not worth it to buy him out any sooner than his final year.

Andrew Ladd, Milan Lucic, Kyle Okposo all signed deals heavily impacted by signing bonuses, protecting them against a buyout through all but the very end of their agreements. Even Matt Martin, a career fourth liner secured a $10MM deal that is 65% bonus. He’ll only be collecting $750K in salary in years three and four of the deal.

While this doesn’t necessarily mean trouble for clubs around the league, you can bet the owners and NHLPA will take a look at it when negotiations begin on the new CBA. The current agreement expires in 2022, though the two sides have the option to end it a year earlier.

Just as the league has used cap recapture and contract limits to close loopholes in the past, be sure that if they want to continue to have the option to buyout bad contracts they’ll remove this option from the equation. Creating a rule that would make signing bonuses only be able to hit a certain percentage of each season’s salary would be the easy fix, but expect push-back from the NHLPA.

Even if they do end up closing it, agents will work on another way to get their clients the best possible guarantee; they always seem to be one step ahead of the league.

Cap Space For Each Team Heading Into Free Agency

With the free agent market ready to open up, here is a closer look at what each team has to spend and how many roster spots they have filled (the maximum roster size is 23). All numbers are courtesy of Cap Friendly.

Anaheim: $14.8MM in cap space, 16 players signed

Arizona: $26.3MM in cap space, 14 players signed

Boston: $17.6MM in cap space, 16 players signed

Buffalo: $18.0MM in cap space, 19 players signed

Calgary: $21.0MM in cap space, 18 players signed

Carolina: $26.0MM in cap space, 18 players signed

Chicago: $5.2MM in cap space, 19 players signed

Colorado: $20.9MM in cap space, 15 players signed

Columbus: $4.4MM in cap space, 19 players signed

Dallas: $14.2MM in cap space, 17 players signed

Detroit: $13.3MM in cap space, 19 players signed

Edmonton: $14.4MM in cap space, 23 players signed

Florida: $18.0MM in cap space, 20 players signed

Los Angeles: $7.9MM in cap space, 19 players signed

Minnesota: $11.6MM in cap space, 16 players signed

Montreal: $9.2MM in cap space, 21 players signed

Nashville: $9.3MM in cap space, 19 players signed

New Jersey: $24.9MM in cap space, 16 players signed

NY Islanders: $14.6MM in cap space, 18 players signed

NY Rangers: $15.3MM in cap space, 15 players signed

Ottawa: $18.4MM in cap space, 18 players signed

Philadelphia: $12.0MM in cap space, 17 players signed

Pittsburgh: $1.5MM over the cap, 23 players signed

San Jose: $9.1MM in cap space, 17 players signed

St. Louis: $14.2MM in cap space, 19 players signed

Tampa Bay: $13.0MM in cap space, 18 players signed

Toronto: $3.8MM in cap space, 21 players signed

Vancouver: $10.1MM in cap space, 21 players signed

Washington: $8.9MM in cap space, 19 players signed

Winnipeg: $20.1MM in cap space, 19 players signed

Note that these amounts don’t factor in any potential LTIR savings for players that are signed but are not expected to play next season.

The Steven Stamkos Contract And Its Long Term Effects

Had it happened at any point over the last year, Tampa Bay captain Steven Stamkos re-signing with the Lightning would have been the top story of the day and dominated the conversation. However, on a day where big names were being traded left, right, and center, the Markham-native forgoing unrestricted free agency seemed like a side note.

Sportsnet’s Elliotte Friedman reports the structure of Stamkos’ new contract being heavily bonus-laden: Stamkos will make a $1MM salary with the rest in bonuses. Friedman has the salary at five years of $9.5MM, followed by $7.5MM and two years of $6.5MM. That’s a total of $68MM over 8 years, for a cap hit of $8.5MM, which is only $1MM higher than his expiring contract.

It’s a similar structure to the contracts of David Clarkson and Ryan O’Reilly, with great benefits to the player in the event of a lockout or buyout: Stamkos will still get the signing bonus money if the NHL goes through another lockout in 2023 at the expiration of the current CBA. As well, should the Lightning ever want to buy him out (don’t laugh, they bough out Vincent Lecavalier), it would cost the team $2.83MM per season. That’s 283% of his actually salary. (Buyout calculation done on General Fanager).

The feel-good aspect of the signing is this: Stamkos took less money to stay than he could have gotten on the open market (not factoring taxes). He wants to retire a member of the Lightning. In the Lightning’s press release, Stamkos was quoted as saying “it’s not often that a player gets the chance to spend his career in one organization and I am hopeful that this agreement sets me on that path”.

However, the part that is going to make Lightning fans nervous is how it will affect the team around Stamkos. The team has $9.3MM in space for next season. However, leading scorer Nikita Kucherov still needs a new contract after being qualified earlier this week, as does two-way winger Alex Killorn. Those two contracts are doable; it’s next summer where it could get ugly. Top defenceman Victor Hedman, both starting goalie Ben Bishop and goalie-of-the-future Andrei Vasilevskiy, and forwards Jonathan Drouin, Tyler Johnson and Ondrej Palat will all see their contracts expire.

One of the goalies will likely be traded before then, but the rest of the group will cost serious money to keep together. Defenceman Matt Carle has two years left at $5.5MM and figures to be traded or bought out to save space for the upcoming group of free agents. This is also where gritty winger Ryan Callahan‘s contract is going to hurt. Callahan will make $5.8MM annually until 2020, but scored just 28 points in 73 games last season and is on the wrong side of 30.

Wily GM Steve Yzerman will have his hands full again this season, after masterfully handling the Drouin and Stamkos sagas last season. It’s going to be a very interesting year for the Lightning and their fans.

Capology: Restricted Free Agents (Part I)

Restricted Free Agents can sign with any team once their SPC expires, but the player’s prior club can either match the new contract—called an offer sheet—or receive compensatory draft picks from the RFA’s new team. It allows a young player the opportunity to experience free agency while giving teams a exclusive chance to match any offer their player may receive.

Who is Eligible to be an RFA?

A player generally becomes an RFA after his first contract expires. Essentially, RFA status is tied to a player’s age* when he signed his first SPC:

18-21 when signing ELC: RFA after 3 years of pro experience

22-23 when signing ELC: RFA after 2 years of pro experience

24+ when signing ELC: RFA after 1 year of pro experience

Age is defined as the players age on September 15th of the year he signed his first SPC. Professional experience however, depends on a player’s age. For players 18 and 19, professional experience is 10+ games in the NHL. For players 20+, professional experience is merely 10+ games in any professional league.

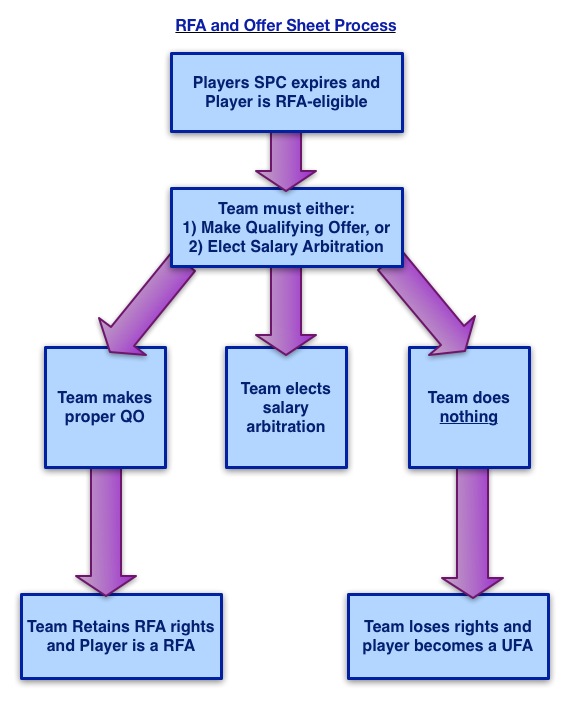

Just because a player is eligible to be an RFA, however, does not automatically bestow RFA status. As explained below, a team must either make the player a Qualifying Offer (QO) or elect to take the player to salary arbitration. If a team does neither, the player becomes a UFA.

Flowchart Illustraing NHL RFA Timeline

What is a Qualifying Offer?

A qualifying offer (QO) is an offer of a one year SPC by a player’s team. The CBA requires that the SPC meet certain terms and conditions:

Salary

An SPC’s minimum salary is determined by a player’s previous year’s NHL Salary

- If a player’s previous year’s NHL salary was $660,000 or less, the SPC must offer a minimum of 110% of the player’s previous year’s salary;

- If a player’s previous year’s NHL salary was greater than $660,000 but less than $1,000,000, the SPC salary must be at least 105% of the player’s previous salary but cannot exceed $1,000,000; or

- If a player’s previous year’s NHL salary was equal to or greater than $1,000,000, then the SPC salary must be 100% of the player’s previous salary.

One-way and Two-way

Most QOs are two-way (meaning that the player receives a minor league salary if he is sent down). A QO must be one-way, however, if the player meets the following conditions:

- played at least 180 NHL games in the previous three NHL seasons;

- played at least 60 NHL games in the previous season; and

- did not clear waivers during the regular season waiver period.

Qualifying offers sheets are predominantly a formality. Teams are required to make an offer so they can retain a player’s RFA rights. Players can reject a team’s QO—something they usually do. Once the QO expires, both the team and the player will negotiate a more lucrative deal.

When Does a Team Make a Qualifying Offer?

A team seeking to retain its rights in RFA players (and not electing arbitration) must tender the QO by the later of June 25th or the first Monday after the NHL Entry Draft. That means that a player must receive the offer by that date. A late QO is insufficient, and the player immediately becomes a UFA.*

When Can a Player Accept a Qualifying Offer?

Even though a QO must be offered in June, a player cannot accept a QO until July 1st. The QO is open for two weeks until it expires on July 15th.

What if a Team does not Make a Qualifying Offer?

If a team does not make a Qualifying Offer by the CBA-imposed deadline, the RFA-eligible player immediately becomes an unrestricted free agent.

So an RFA either receives a QO, or becomes a free agent. If they receive a QO, they can still sign with another team, but their original team has right of first refusal. This process is called the offer sheet process. See our forthcoming post on offer sheet soon.

* in 2010, the Chicago Blackhawks tendered their QOs late, and their RFA-eligible players became UFAs